Press Release

Griffon Corporation Announces Third Quarter Results

Revenue increases 14% to $327 million

Segment Adjusted EBITDA increases 14% to $29 million

Anticipates Closing of $542 Million Acquisition of Ames True Temper in 4Q10

NEW YORK, NEW YORK, August 2, 2010 – Griffon Corporation (NYSE: GFF) today reported financial results for the third quarter ended June 30, 2010.

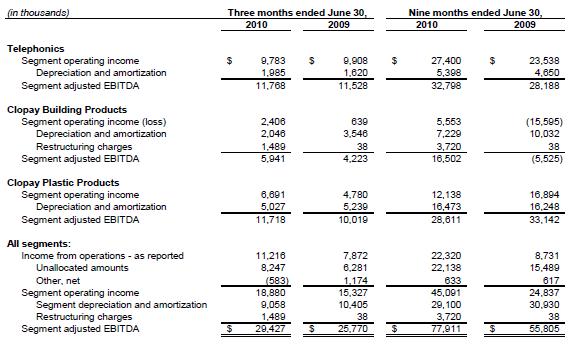

Quarterly revenue totaled $327 million, increasing 14% compared to $287 million reported in the 2009 quarter. Segment adjusted EBITDA grew 14% to $29 million, compared to $26 million in the prior year quarter; segment adjusted EBITDA is defined as income from continuing operations, excluding corporate overhead, interest, taxes, depreciation and amortization, restructuring charges and the benefit (loss) of debt extinguishment.

Net income for the quarter was $5.0 million or $0.08 per diluted share, compared to $6.1 million or $0.10 per diluted share in the 2009 quarter. The 2010 quarter included $1.0 million net of tax or $0.02 per diluted share of restructuring charges in connection with the consolidation of Building Products’ manufacturing facilities; there were no comparable charges in the prior year quarter. The 2009 quarter included favorable discrete period tax adjustments of $1.6 million or $0.03 per diluted share. Excluding the restructuring charges and the discrete period tax adjustments from the respective 2010 and 2009 quarterly results, net income in the third quarter 2010 would have been $5.9 million or $0.10 per diluted share compared $4.6 million or $0.08 per diluted share in the prior year, a growth rate of 25%.

Ron Kramer, Chief Executive Officer, commented, “We are pleased with the results of our third quarter, which demonstrate continued growth in both revenue and EBITDA in each segment of our business. In particular, we are excited by the strong performance shown by Building Products, which continues to benefit from our repositioning and restructuring activities. We are also pleased to see significant revenue and market share gains in our specialty plastics business. Telephonics captured significant new contracts and is well-positioned for renewed growth and an extension of our leadership position.”

Mr. Kramer continued, “In late July, we announced the acquisition of Ames True Temper or ATT for $542 million for which the arranged financing is collateralized by Clopay and ATT assets. ATT is the leading North American manufacturer and marketer of non-powered lawn and garden tools, wheelbarrows, and other outdoor work products to the retail and professional markets. We are excited about the growth opportunities ATT has both in North America and around the world. We are confident that this transaction will provide significant initial value to our shareholders as well as enhance our ability to grow for the longterm. We look forward to closing this transaction before the end of September 2010.”

The Company noted that, on October 1, 2009, it adopted the new accounting standard which requires the liability and equity components of convertible debt instruments to be separately accounted for using the Company’s nonconvertible debt rate. Adoption of this standard must be applied retrospectively; as a result, the prior year’s third quarter income from continuing operations and net income were each reduced by $0.8 million and the related diluted earnings per share by $0.02.

Results of Operations

Clopay Plastic Products

Plastics revenue increased $28 million, or 29%, compared to the prior year quarter. The increase was primarily due to higher volume from new customer wins and expanded programs with existing customers as well as by higher customer selling prices driven by the pass through of higher resin costs.

For the quarter ended June 30, 2010, Segment operating income increased by $2 million, or 40%, compared to the prior year quarter. The benefit of the improved volume in the current quarter was partially offset by the negative impact of higher resin costs not yet passed through to customers in the form of higher selling prices.

Clopay Building Products

Building Products revenue increased 6%, or $6 million, to $104 million compared to the prior year quarter. The increase was primarily driven by higher residential door volume, partially offset by the continued effects of the weak commercial construction market.

Segment operating income increased $2 million, or 276% compared to the prior year quarter. The operating performance was driven by the increased volume, improved plant absorption and lower product costs driven by the various restructuring activities undertaken over the past several quarters.

Building Products’ facilities consolidation project remains on schedule, with expected completion in early calendar 2011.

Telephonics

Telephonics revenue increased $6 million, or 7%, to $100 million compared to the prior year quarter, primarily attributable to the Crew 3.1 contract.

Segment operating income of $10 million was essentially flat with the prior year quarter, and operating profit margin decreased 80 basis points to 9.7% from the prior year quarter. This was primarily due to the CREW 3.1 sales, which contributed a lower average gross margin than other parts of the Telephonics portfolio.

During the quarter, Telephonics was awarded several new contracts and received incremental funding on current contracts totaling $73 million. Contract backlog was $405 million at June 30, 2010 with 64% expected to be realized in the next 12 months.

During the quarter, Telephonics received notification that it had been selected as the provider of the maritime surveillance radar system on the Fire Scout, the U.S. Navy’s Vertical Take-off and Landing Unmanned Aerial Vehicle. This is expected to be a significant, long-term program and more details will be provided when available.

Unallocated Expenses

For the quarter ended June 30, 2010, unallocated expenses include approximately $0.3 million of costs incurred in connection with evaluating various acquisition opportunities; there was no comparable expense in the prior year quarter.

Balance Sheet and Capital Expenditures

Cash and equivalents at June 30, 2010 totaled $352 million. Total debt outstanding at June 30, 2010 was $199 million, for a net cash position of $153 million. Capital expenditures in the third quarter were $9 million and are expected to be approximately $40 - $45 million for the full year 2010.

On July 19, 2010, substantially all of the $50 million of outstanding 2023 Notes were put to the Company at par and settled.

Conference Call Information

The Company will hold a conference call today, August 2, 2010, at 4:30 PM ET.

The call can be accessed by dialing 1-877-407-4018 (U.S. participants) or 1-201-689-8471 (International participants). Callers should ask to be connected to Griffon Corporation’s third quarter fiscal 2010 teleconference.

A replay of the call will be available starting today, August 2, 2010 at 7:30 PM ET by dialing 1-877-660- 6853 (U.S.) or 1-212-612-7415 (International). The replay account number is 3055 with access code 354605. The replay will be available through August 16, 2010.

Forward-looking Statements

“Safe Harbor” Statements under the Private Securities Litigation Reform Act of 1995: All statements related to, among other things, income, earnings, cash flows, revenue, changes in operations, operating improvements, industries in which Griffon Corporation (the “Company” or “Griffon”) operates and the United States and global economies that are not historical are hereby identified as “forward-looking statements” and may be indicated by words or phrases such as “anticipates,” “supports,” “plans,” “projects,” “expects,” “believes,” “should,” “would,” “could,” “hope,” “forecast,” “management is of the opinion,” “may,” “will,” “estimates,” “intends,” “explores,” “opportunities,” the negative of these expressions, use of the future tense and similar words or phrases. Such forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed in any forward-looking statements. These risks and uncertainties include, among others: current economic conditions and uncertainties in the housing, credit and capital markets; the Company’s ability to achieve expected savings from cost control, integration and disposal initiatives; the ability to identify and successfully consummate and integrate value-adding acquisition opportunities, including the planned acquisition of ATT; increasing competition and pricing pressures in the markets served by Griffon’s operating companies; the ability of Griffon’s operating companies to expand into new geographic and product markets and to anticipate and meet customer demands for new products and product enhancements and innovations; the government reduces military spending on projects supplied by Telephonics Corporation; increases in cost of raw materials such as resin and steel; changes in customer demand; political events that could impact the worldwide economy; a downgrade in the Company’s credit ratings; international economic conditions including interest rate and currency exchange fluctuations; the relative mix of products and services which impacts margins and operating efficiencies; short-term capacity constraints or prolonged excess capacity; unforeseen developments in contingencies such as litigation; unfavorable results of government agency contract audits of Telephonics Corporation; protection and validity of patent and other intellectual property rights; the cyclical nature of the business of certain Griffon operating companies; and possible terrorist threats and actions, and their impact on the global economy. Such statements reflect the views of the Company with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to the operations, results of operations, growth strategy and liquidity of the Company as previously disclosed in the Company’s Securities and Exchange Commission filings. Readers are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements speak only as of the date made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

About Griffon Corporation

Griffon Corporation (the “Company” or “Griffon”), is a diversified management and holding company that conducts business through wholly-owned subsidiaries. The Company oversees the operations of its subsidiaries, allocates resources among them and manages their capital structures. The Company provides direction and assistance to its subsidiaries in connection with acquisition and growth opportunities as well as in connection with divestitures. Griffon also seeks out, evaluates and, when appropriate, will acquire additional businesses that offer potentially attractive returns on capital to further diversify itself.

Griffon currently conducts its operations through Telephonics Corporation, Clopay Building Products Company and Clopay Plastic Products Company.

- Telephonics Corporation’s high-technology engineering and manufacturing capabilities provide integrated information, communication and sensor system solutions to military and commercial markets worldwide.

- Clopay Building Products Company is a leading manufacturer and marketer of residential, commercial and industrial garage doors to professional installing dealers and major home center retail chains.

- Clopay Plastic Products Company is an international leader in the development and production of embossed, laminated and printed specialty plastic films used in a variety of hygienic, healthcare and industrial applications.

For more information on the Company and its operating subsidiaries, please see the Company's website at www.griffoncorp.com.

| Company Contact: | Investor Relations Contact: |

| Douglas J. Wetmore | James Palczynski |

| Chief Financial Officer | Principal and Director |

| Griffon Corporation | ICR Inc. |

| (212) 957-5000 | (203) 682-8229 |

| 712 Fifth Avenue, 18th Floor | |

| New York, NY 10019 |

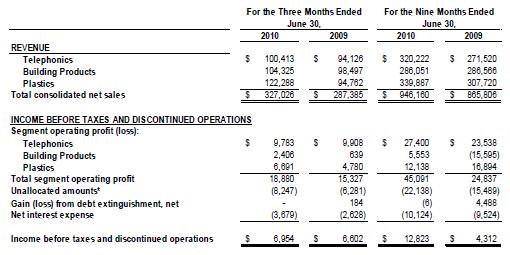

GRIFFON CORPORATION AND SUBSIDIARIES

OPERATING HIGHLIGHTS

(Unaudited)

(in thousands)

*Unallocated amounts typically include general corporate expenses not attributable to any reportable segment.

Prior year amounts have been adjusted for the adoption of the new accounting standard for convertible debt.

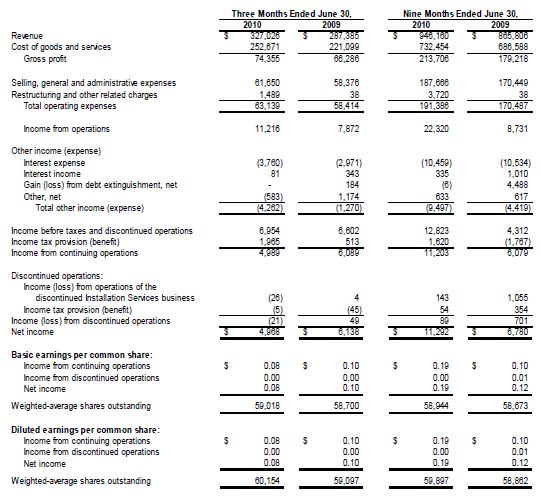

GRIFFON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share data)

Note: Due to rounding, the sum of earnings per share of Continuing operations and Discontinued operations may not equal earnings per share of Net income.

Prior year amounts have been adjusted for the adoption of the new accounting standard for convertible debt.

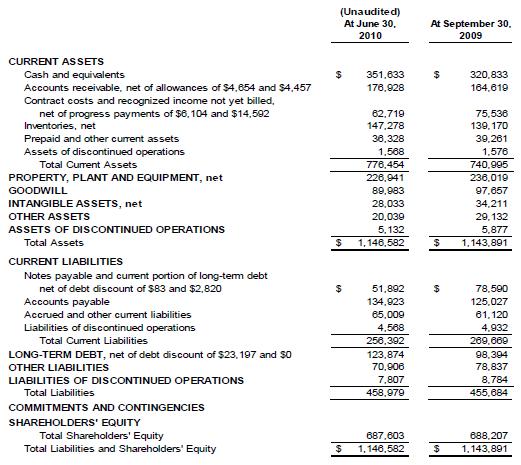

GRIFFON CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands)

Prior year amounts have been adjusted for the adoption of the new accounting standard for convertible debt.

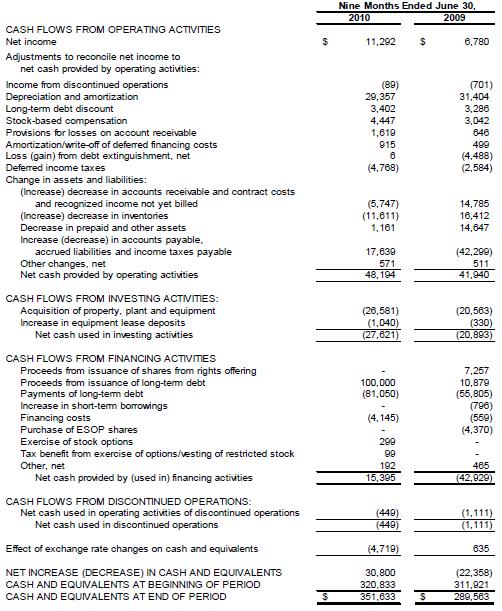

GRIFFON CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

Prior year amounts have been adjusted for the adoption of the new accounting standard for convertible debt.

The following is a reconciliation of operating income, which is a GAAP measure of Griffon’s operating results, to segment operating income and segment adjusted EBITDA. Management believes that the presentation of segment operating income, segment EBITDA and segment adjusted EBITDA is appropriate to provide additional information about the Company’s reportable segments. Segment operating income and segment adjusted EBITDA are not presentations made in accordance with GAAP, are not measures of financial performance or condition, liquidity or profitability of the Company, and should not be considered as an alternative to (1) net income, operating income or any other performance measures determined in accordance with GAAP or (2) operating cash flows determined in accordance with GAAP. Additionally, segment operating income and segment adjusted EBITDA are not intended to be measures of cash flow for management’s discretionary use, as they do not consider certain cash requirements such as interest payments, tax payments, capital expenditures and debt service requirements.

GRIFFON CORPORATION AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES

BY REPORTABLE SEGMENT

(Unaudited)

Unallocated amounts typically include general corporate expenses not attributable to any reportable segment.