Griffon confirms receipt of director nomination from Voss Capital

Business model has delivered results with revenue, adjusted EBITDA and adjusted earnings per share 3-year CAGRs of 11%, 23% and 35%, respectively

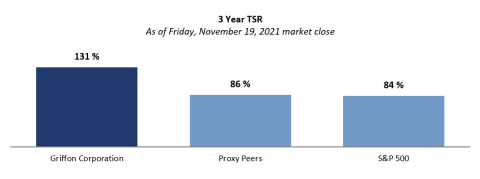

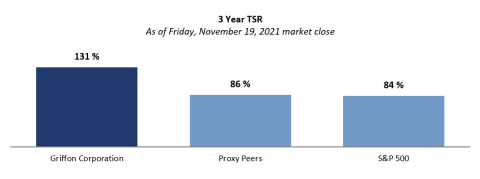

Proven track record of shareholder value-creation with 3-year total shareholder return of approximately 130%, meaningfully outperforming both the S&P 500 and proxy peer group

Highly engaged Board committed to refreshment, diversity and enhanced corporate governance practices, having refreshed six directors over last five years

NEW YORK--(BUSINESS WIRE)--Nov. 23, 2021--

Griffon Corporation (“Griffon” or the “Company”) (NYSE: GFF) today confirmed that Voss Capital, LLC ("Voss"), a new 2% shareholder of the company, has provided notice of its intent to nominate three individuals to stand for election to the Griffon Board of Directors at the 2022 Annual Meeting of Shareholders, currently scheduled for February 17, 2022.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211123006051/en/

(Graphic: Business Wire)

Griffon issued the following statement:

“The Board and management team are committed to acting in the best interest of all shareholders. We have carefully reviewed Voss’ assessments and have concluded they are inaccurate. We have been, and will continue to be, proactive in making the decisions to propel the company forward, including the execution of a successful M&A strategy that has allowed for optimal capital redeployment and significant return of capital to shareholders. We intend to continue executing on our strategy to reposition Griffon including through transactions such as the ongoing strategic alternatives review of Telephonics Corporation.

“We have engaged in good faith with Voss to date. Independent members of the Board have met with them and are currently assessing their nominees in accordance with our thorough process. While we are disappointed by Voss’ decision to create public disruption, and despite their misleading statements, we remain open to engaging with them. We have always welcomed constructive dialogue with our shareholders and remain committed to creating shareholder value as well as acting in the best interest of all shareholders.

Strong track record of value-enhancing acquisitions and divestitures

“Griffon’s investment and operating-centric model has delivered strong results. Since December 2013, we have successfully executed 12 acquisitions and 2 major divestitures. We transformed our portfolio through the sale of the Clopay Plastics business and the immediately accretive acquisitions, including the acquisitions of ClosetMaid and CornellCookson. Our announcement of strategic alternatives for Telephonics marks another fundamental shift in our portfolio. Our disciplined capital allocation approach has created value for shareholders by successfully redeploying capital towards the highest return alternatives including accretive acquisitions, while returning capital to shareholders through dividends and share repurchases.

“Over the last three years, our actions have fundamentally strengthened Griffon with revenue, adjusted EBITDA and adjusted earnings per share CAGRs of 11%, 23% and 35%, respectively. Over this same period, we generated $224 million in free cash flow and reduced our leverage by half to 2.8x, before the benefits we expect to realize from the Telephonics strategic review.

Griffon’s leading global product portfolio is strategically positioned for growth and increased profitability

“We have built market leading positions in every product category in both our Consumer and Professional Products (CPP) and our Home and Building Products (HBP) businesses and are positioned to capitalize on the consistent strength of the housing market and homeowner activity.

“Our CPP business has a broad, iconic portfolio of market-leading branded products, many with 100+ year legacies that are widely recognized and respected by consumers and professionals. We have strong long-term customer relationships and extensive design, manufacturing and logistics capabilities. In 2021, this business delivered 8% revenue growth and 11% EBITDA increase year-over-year.

“Our HBP business has premium, recognized brands that are market leaders in their essential product categories. We have extensive design, manufacturing and logistics capabilities and a strong network of professional dealers. Our investments in technology and capacity are driving innovation and growth. In 2021, this business delivered record revenue and EBITDA, with 12% and 18% year-over-year growth, respectively.

“Our record performance in 2021 is a direct result of our ability to realize the benefits of the strategic actions we’ve taken to strengthen the company and position ourselves for future growth and increased profitability.

Griffon’s proven track record of shareholder value-creation

“Over the past three years, our proactive portfolio transformation has rewarded investors, delivering a total shareholder return of approximately 130%, meaningfully outperforming both the S&P 500 and our proxy peer group by approximately 50%, over this period.

Griffon’s Board is highly engaged, committed to diversity and enhanced corporate governance practices

“We value diversity and are committed to a Board refreshment process that ensures that our Board’s composition reflects the mix of skills and expertise we need as we execute our strategy. Over the past five years, we have refreshed six of our directors, adding diversity and relevant expertise to our Board. Currently, tenure for approximately 45% of our Board members is less than four years and the median tenure of our directors is six years. In addition, our Board has committed to further diversity with an objective that, by 2025, 40% of our independent directors will be women or persons of color.

“Our Board recently adopted two amendments to our Certificate of Incorporation for submission to our shareholders at our 2022 Annual Meeting. The first amendment will declassify the Board over a three-year transition period after the amendment becomes effective. The second amendment will reduce the percentage of voting power necessary to call a special meeting of shareholders. These amendments will become effective subject to the approval of our shareholders at our 2022 Annual Meeting.

“We believe that these enhancements to our corporate governance practices will further align our interests with those of our shareholders and contribute to maximizing long-term shareholder value.”

Forward-looking Statements

“Safe Harbor” Statements under the Private Securities Litigation Reform Act of 1995: All statements related to, among other things, income (loss), earnings, cash flows, revenue, changes in operations, operating improvements, industries in which Griffon operates and the United States and global economies that are not historical are hereby identified as “forward-looking statements” and may be indicated by words or phrases such as “anticipates,” “supports,” “plans,” “projects,” “expects,” “believes,” “should,” “would,” “could,” “hope,” “forecast,” “management is of the opinion,” “may,” “will,” “estimates,” “intends,” “explores,” “opportunities,” the negative of these expressions, use of the future tense and similar words or phrases. Such forward-looking statements are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed in any forward-looking statements. These risks and uncertainties include, among others: current economic conditions and uncertainties in the housing, credit and capital markets; Griffon's ability to achieve expected savings from cost control, restructuring, integration and disposal initiatives; the ability to identify and successfully consummate, and integrate, value-adding acquisition opportunities; increasing competition and pricing pressures in the markets served by Griffon’s operating companies; the ability of Griffon’s operating companies to expand into new geographic and product markets, and to anticipate and meet customer demands for new products and product enhancements and innovations; reduced military spending by the government on projects for which Griffon's Telephonics Corporation supplies products, including as a result of defense budget cuts or other government actions; the ability of the federal government to fund and conduct its operations; increases in the cost or lack of availability of raw materials such as resin, wood and steel, components or purchased finished goods, including the impact from tariffs; changes in customer demand or loss of a material customer at one of Griffon's operating companies; the potential impact of seasonal variations and uncertain weather patterns on certain of Griffon’s businesses; political events that could impact the worldwide economy; a downgrade in Griffon’s credit ratings; changes in international economic conditions including interest rate and currency exchange fluctuations; the reliance by certain of Griffon’s businesses on particular third party suppliers and manufacturers to meet customer demands; the relative mix of products and services offered by Griffon’s businesses, which impacts margins and operating efficiencies; short-term capacity constraints or prolonged excess capacity; unforeseen developments in contingencies, such as litigation, regulatory and environmental matters; unfavorable results of government agency contract audits of Telephonics Corporation; our strategy, future operations, prospects and the plans of our businesses, including the exploration of strategic alternatives for Telephonics Corporation; Griffon’s ability to adequately protect and maintain the validity of patent and other intellectual property rights; the cyclical nature of the businesses of certain of Griffon’s operating companies; and possible terrorist threats and actions and their impact on the global economy; the impact of COVID-19 on the U.S. and the global economy, including business disruptions, reductions in employment and an increase in business and operating facility failures, specifically among our customers and suppliers; Griffon's ability to service and refinance its debt; and the impact of recent and future legislative and regulatory changes, including, without limitation, changes in tax law. Such statements reflect the views of the Company with respect to future events and are subject to these and other risks, as previously disclosed in the Company’s Securities and Exchange Commission filings. Readers are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements speak only as of the date made. Griffon undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Important Additional Information Regarding Proxy Solicitation

Griffon intends to file a proxy statement and associated WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for Griffon’s 2022 Annual Meeting (the “Proxy Statement”). Griffon, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2022 Annual Meeting. Information regarding the names of Griffon’s directors and executive officers and their respective interests in Griffon by security holdings or otherwise is set forth in Griffon’s proxy statement for the 2021 Annual Meeting of Shareholders, filed with the SEC on December 16, 2020. To the extent holdings of such participants in Griffon’s securities have changed since the amounts set forth in the 2021 proxy statement, such changes have been reflected on Statements of Change in Ownership on Form 4 or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC. Details concerning the nominees of Griffon’s Board of Directors for election at the 2022 Annual Meeting will be included in the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD, AND ANY SUPPLEMENTS THERETO, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain a copy of the definitive Proxy Statement and other relevant documents filed by Griffon with the SEC free of charge from the SEC’s website, www.sec.gov., or by directing a request by mail to Griffon Corporation, Attention: Corporate Secretary, at 712 Fifth Avenue, New York, NY 10019, or by visiting the investor relations section of Griffon’s website, www.griffon.com.

About Griffon Corporation

Griffon Corporation is a diversified management and holding company that conducts business through wholly-owned subsidiaries. Griffon oversees the operations of its subsidiaries, allocates resources among them and manages their capital structures. Griffon provides direction and assistance to its subsidiaries in connection with acquisition and growth opportunities as well as divestitures. In order to further diversify, Griffon also seeks out, evaluates and, when appropriate, will acquire additional businesses that offer potentially attractive returns on capital.

Griffon conducts its operations through two reportable segments:

-

Consumer and Professional Products conducts its operations through The AMES Companies, Inc. (“AMES”). Founded in 1774, AMES is the leading North American manufacturer and a global provider of branded consumer and professional tools and products for home storage and organization, landscaping, and enhancing outdoor lifestyles. CPP sells products globally through a portfolio of leading brands including True Temper, AMES, and ClosetMaid.

-

Home and Building Product conducts its operations through Clopay Corporation (“Clopay”). Founded in 1964, Clopay is the largest manufacturer and marketer of garage doors and rolling steel doors in North America. Residential and commercial sectional garage doors are sold through professional dealers and leading home center retail chains throughout North America under the brands Clopay, Ideal, and Holmes. Rolling steel door and grille products designed for commercial, industrial, institutional, and retail use are sold under the CornellCookson brand.

Classified as a discontinued operation, Defense Electronics conducts its operations through Telephonics, founded in 1933, a globally recognized leading provider of highly sophisticated intelligence, surveillance and communications solutions for defense, aerospace and commercial customers.

For more information on Griffon and its operating subsidiaries, please see the Company’s website at www.griffon.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211123006051/en/

Company:

Brian G. Harris

ir@griffon.com

SVP & Chief Financial Officer

Griffon Corporation

(212) 957-5000

Media:

Lauren Odell / Patricia Figueroa

Griffon@gladstoneplace.com

Gladstone Place Partners

212-230-5930

Investors:

Jeanne Carr / Daniel Burch

jcarr@mackenziepartners.com

dburch@mackenziepartners.com

MacKenzie Partners

1 800-322-2885

Source: Griffon Corporation